ACME has been sponsoring a series of contests, tournaments, and challenges for young students and serving as the primary sponsor of the Global Investment Contest program since 2013.

China Connect Investment Challenge

China Connect Investment Challenge ("CCIC") was launched in 2014, as the first official global investment completion endorsed by the Hong Kong Stock Exchange ("HKEX"). The global final competition of the CCIC was held at the Executive Board Room at the HKEX, where the champion and the finalists hit the market opening gang together with the president Charles Li of the Hong Kong Stock Exchange. The Challenge aims to promote and facilitate the initiative of the “Shanghai-Hong Kong Stock Connect” program. CCIC was supported by ACME Society, HKEX, China Merchants Securities, and Starsinvest Lab, Larson International and YOUniversity.

China Connect Investment Challenge ("CCIC") was launched in 2014, as the first official global investment completion endorsed by the Hong Kong Stock Exchange ("HKEX"). The global final competition of the CCIC was held at the Executive Board Room at the HKEX, where the champion and the finalists hit the market opening gang together with the president Charles Li of the Hong Kong Stock Exchange. The Challenge aims to promote and facilitate the initiative of the “Shanghai-Hong Kong Stock Connect” program. CCIC was supported by ACME Society, HKEX, China Merchants Securities, and Starsinvest Lab, Larson International and YOUniversity.

China Alpha Investing Challenge

Trading Contest

The China Alpha Contest allows contestants to invest in preselected U.S. listed China related stocks. Selling Short is allowed. This contest focuses on stock picking and hedging strategy. The Challenge is sponsored and run by SKT Education.

The China Alpha Contest allows contestants to invest in preselected U.S. listed China related stocks. Selling Short is allowed. This contest focuses on stock picking and hedging strategy. The Challenge is sponsored and run by SKT Education.

University Endowments Investing Challenge

Trading Contest

The endowment fund of the top universities in the United States is recognized as the institution with the longest investment horizon and strength. It not only provides hundreds of millions of dollars in research and teaching funding for each school, but also provides a superior asset allocation model. This competition will encourage contestants to research and challenge the investment models of top universities, build customized ETFs and stocks portfolio, and compete performance during the competition.

The endowment fund of the top universities in the United States is recognized as the institution with the longest investment horizon and strength. It not only provides hundreds of millions of dollars in research and teaching funding for each school, but also provides a superior asset allocation model. This competition will encourage contestants to research and challenge the investment models of top universities, build customized ETFs and stocks portfolio, and compete performance during the competition.

SDG & ESG Investing Challenge

Trading and Research Contest

The United Nations Sustainable Development Goals (SDGs) aim to eradicate poverty through concerted action, protect the planet and ensure peace and prosperity for mankind. This Investing Challenge advocates the standard of the social responsibility, ESG, CSR and other measurement indicators to create a new model for investment in the new era to achieve the goal of UN 2030 SDG.

The United Nations Sustainable Development Goals (SDGs) aim to eradicate poverty through concerted action, protect the planet and ensure peace and prosperity for mankind. This Investing Challenge advocates the standard of the social responsibility, ESG, CSR and other measurement indicators to create a new model for investment in the new era to achieve the goal of UN 2030 SDG.

Value Investing Contest

Research Contest

Value Investing Contest allows participants to conduct fundamental research and make investments recommendations based on fundamental analysis.

VALUE INVESTING has been around since the beginning of investing history. Legendary investing author Benjamin Graham is the widely considered to be the father of modern security analysis and value investing. Graham and David Dodd, another Columbia academic, introduced the concept of intrinsic value and the wisdom of buying stocks at a discount to that value. Graham’s ability to find profitable investing ideas led him to start the Graham-Newman Partnership in 1926. The Graham-Newman partnership prospered, boasting an average annual return of 17% until its termination in 1956. It was at this firm that Warren Buffett worked early in his career, learning from the master. Graham also blazed trails for the profession of investing and helped start what would later become the CFA Institute.

Value Investing Defined

Value investing is the strategy of choosing stocks that are undervalued and investing in those for future profits. Markets overreact to both positive and negative news, resulting in stock price movements that do not correspond with the company's long-term fundamentals. The result is an opportunity for value investors to profit by buying when the share price is low. That is why value investors are often referred to as bargain hunters or even treasure hunters. Typically, value investors select stocks that trade at discounts to book value, have high dividend yields, have low price-to-earnings multiples or have low price-to-book ratios.

Value Investing is generally considered to be:

Graham’s Stocks Selection Criteria

It was in the first edition of Security Analysis that Ben Graham put his mind to converting his views on markets to specific screens that could be used to find undervalued stocks. Graham suggested that the first five are essentially valuation criteria, and the following five are criteria that ensure the financial health of the business.

Value Investing Contest allows participants to conduct fundamental research and make investments recommendations based on fundamental analysis.

VALUE INVESTING has been around since the beginning of investing history. Legendary investing author Benjamin Graham is the widely considered to be the father of modern security analysis and value investing. Graham and David Dodd, another Columbia academic, introduced the concept of intrinsic value and the wisdom of buying stocks at a discount to that value. Graham’s ability to find profitable investing ideas led him to start the Graham-Newman Partnership in 1926. The Graham-Newman partnership prospered, boasting an average annual return of 17% until its termination in 1956. It was at this firm that Warren Buffett worked early in his career, learning from the master. Graham also blazed trails for the profession of investing and helped start what would later become the CFA Institute.

Value Investing Defined

Value investing is the strategy of choosing stocks that are undervalued and investing in those for future profits. Markets overreact to both positive and negative news, resulting in stock price movements that do not correspond with the company's long-term fundamentals. The result is an opportunity for value investors to profit by buying when the share price is low. That is why value investors are often referred to as bargain hunters or even treasure hunters. Typically, value investors select stocks that trade at discounts to book value, have high dividend yields, have low price-to-earnings multiples or have low price-to-book ratios.

Value Investing is generally considered to be:

- Conservative, relative to other investment disciplines (growth investing, momentum)

- Defensive – as a safeguard against adverse future developments encountered in the stock market

Graham’s Stocks Selection Criteria

It was in the first edition of Security Analysis that Ben Graham put his mind to converting his views on markets to specific screens that could be used to find undervalued stocks. Graham suggested that the first five are essentially valuation criteria, and the following five are criteria that ensure the financial health of the business.

- An earnings-to-price yield at least twice the AAA bond rate

- P/E ratio less than 40% of the highest P/E ratio the stock had over the past 5 years

- Dividend yield of at least 2/3 the AAA bond yield

- Stock price below 2/3 of tangible book value per share

- Stock price below 2/3 of Net Current Asset Value (NCAV)

- Total debt less than book value

- Current ratio great than 2

- Total debt less than 2 times Net Current Asset Value (NCAV)

- Earnings growth of prior 10 years at least at a 7% annual compound rate

- Stability of growth of earnings in that no more than two declines of 5 per cent or more in year-end earnings in the prior 10 years are permissible

Tenets of the Warren Buffett Way

Warren Buffett is considered to be one of the greatest investors of all time. Early on in his investing career, Warren Buffett took Ben Graham’s work as the bedrock upon which he would build his investing philosophy. In Chapter four of The Warren Buffett Way, Robert Hagstrom identifies Buffett’s set of basic principles, or tenets, that guide his decisions.

“…they naturally group themselves into four categories:

Margin of Safety

Warren Buffett calls them "the three most important words in all of investing." Benjamin Graham described the margin of safety for any asset to be the discount between conservatively calculated intrinsic value and the price you paid for that asset. The margin of safety protects the investor from both poor decisions and downturns in the market. Because fair value is difficult to accurately compute, the margin of safety gives the investor room for error. In example, if shares of ABC Inc. currently trade for $60, but the intrinsic value of the share is $100, then the margin of safety is 40%. On a related note, the potential upside of the share is 67%.

Conclusion

As Warren Buffett once said, “Look at market fluctuations as your friend rather than your enemy; profit from folly rather than participate in it.” Value investors take advantage of the fluctuations of the market. They look for value companies with great futures at discount prices. Buying these undervalued stocks delivers outstanding returns over time as the price rises to catch up with the value.

Featured Book Selected By AIC

Warren Buffett is considered to be one of the greatest investors of all time. Early on in his investing career, Warren Buffett took Ben Graham’s work as the bedrock upon which he would build his investing philosophy. In Chapter four of The Warren Buffett Way, Robert Hagstrom identifies Buffett’s set of basic principles, or tenets, that guide his decisions.

“…they naturally group themselves into four categories:

- Business tenets – three basic characteristics of the business itself.

- Is the business simple and understandable?

- Does the business have a consistent operating history?

- Does the business have favorable long-term prospects?

- Management tenets – three important qualities that senior managers must display.

- Is management rational?

- Is management candid with its shareholders?

- Does management resist the institutional imperative?

- Financial tenets – four critical financial decisions that the company must maintain.

- What is the ROE?

- What are the company’s “owner earnings”?

- What are the profit margins?

- Has the company created at least one dollar of market value for every dollar retained?

- Market tenets – two interrelated cost guidelines.

- What is the value of the company?

- Can it be purchased at a significant discount to its value?”

Margin of Safety

Warren Buffett calls them "the three most important words in all of investing." Benjamin Graham described the margin of safety for any asset to be the discount between conservatively calculated intrinsic value and the price you paid for that asset. The margin of safety protects the investor from both poor decisions and downturns in the market. Because fair value is difficult to accurately compute, the margin of safety gives the investor room for error. In example, if shares of ABC Inc. currently trade for $60, but the intrinsic value of the share is $100, then the margin of safety is 40%. On a related note, the potential upside of the share is 67%.

Conclusion

As Warren Buffett once said, “Look at market fluctuations as your friend rather than your enemy; profit from folly rather than participate in it.” Value investors take advantage of the fluctuations of the market. They look for value companies with great futures at discount prices. Buying these undervalued stocks delivers outstanding returns over time as the price rises to catch up with the value.

Featured Book Selected By AIC

The Oracle & Omaha: How Warren Buffett And His Hometown Shaped Each Other

If you are interested to purchase a limited signed edition, pleases contact us.

If you are interested to purchase a limited signed edition, pleases contact us.

Online Resources

Berkshire Hathaway

http://www.berkshirehathaway.com/

Warren Buffett's letters to Berkshire shareholders, press releases, Charlie Munger’s letters to Wesco shareholders, and much more.

Value Investment Institute

http://www.valueinstitute.org/

The site has been set up by a group of Investment professionals and asset managers, all of whom share the core belief that value investment has the greatest chance of delivering strong performance over the long term.

Ben Graham Centre for Value Investing

http://www.bengrahaminvesting.ca/

This website provides some wonderful research and interviews with some value investing legends.

Value Investing Letter

http://www.valueinvestingletter.com/

A news portal providing up-to-the-minute business and value investing articles and videos from the world’s leading publications.

ValueWalk

http://www.valuewalk.com/

A news site covering all breaking financial news with an emphasis on value investing.

Investing for Beginners

http://beginnersinvest.about.com/

Articles, resources, lessons, guides, and other information on basic investments.

How Buffett Invests

http://www.buffettsecrets.com/category/techniques

Buffett FAQ

http://buffettfaq.com/

A compendium of Q&As with Warren Buffett.

Video lectures at Columbia Business School

http://www7.gsb.columbia.edu/valueinvesting/

The archived videos of guest lectures by world renowned investors such as Thomas Russo, Chris Browne, Michael Price, Glenn Greenberg, Mohnish Pabrai, Li Lu. The lectures are about 60-90 minutes in length and provide good insights into the investing styles and philosophies of these successful investors.

Wealthtrack Podcast

http://www.wealthtrack.com/

A variety of guests from equity and fixed income mutual fund managers, authors of best-selling books, economists, historians etc. An excellent weekly half hour program is available on the website as well as via iTunes.

http://www.berkshirehathaway.com/

Warren Buffett's letters to Berkshire shareholders, press releases, Charlie Munger’s letters to Wesco shareholders, and much more.

Value Investment Institute

http://www.valueinstitute.org/

The site has been set up by a group of Investment professionals and asset managers, all of whom share the core belief that value investment has the greatest chance of delivering strong performance over the long term.

Ben Graham Centre for Value Investing

http://www.bengrahaminvesting.ca/

This website provides some wonderful research and interviews with some value investing legends.

Value Investing Letter

http://www.valueinvestingletter.com/

A news portal providing up-to-the-minute business and value investing articles and videos from the world’s leading publications.

ValueWalk

http://www.valuewalk.com/

A news site covering all breaking financial news with an emphasis on value investing.

Investing for Beginners

http://beginnersinvest.about.com/

Articles, resources, lessons, guides, and other information on basic investments.

How Buffett Invests

http://www.buffettsecrets.com/category/techniques

Buffett FAQ

http://buffettfaq.com/

A compendium of Q&As with Warren Buffett.

Video lectures at Columbia Business School

http://www7.gsb.columbia.edu/valueinvesting/

The archived videos of guest lectures by world renowned investors such as Thomas Russo, Chris Browne, Michael Price, Glenn Greenberg, Mohnish Pabrai, Li Lu. The lectures are about 60-90 minutes in length and provide good insights into the investing styles and philosophies of these successful investors.

Wealthtrack Podcast

http://www.wealthtrack.com/

A variety of guests from equity and fixed income mutual fund managers, authors of best-selling books, economists, historians etc. An excellent weekly half hour program is available on the website as well as via iTunes.

A Glossary of Value Investing Terms

Book Value: The value of an asset as declared in a company's accounts.

Discounted Cash Flow (DCF): A valuation method used to estimate the attractiveness of an investment opportunity. Discounted cash flow (DCF) analysis uses future free cash flow projections and discounts them (most often using the weighted average cost of capital) to arrive at a present value, which is used to evaluate the potential for investment. If the value arrived at through DCF analysis is higher than the current cost of the investment, the opportunity may be a good one.

Discount Rate: An interest rate used to bring future values into the present when considering the time value of money.

Dividend Discount Model (DDM): A means of estimating (not calculating) the value of company based on its dividend payouts, assuming certain increases to the dividend and growth in the company.

EBITDA/EV Multiple: A financial ratio that measures a company's return on investment. The EBITDA/EV ratio may be preferred over other measures of return because it is normalized for differences between companies. Using EBITDA normalizes for differences in capital structure, taxation and fixed asset accounting. Meanwhile, using enterprise value also normalizes for differences in a company’s capital structure.

Generally Accepted Accounting Principles (GAAP): The common set of accounting principles, standards and procedures that companies use to compile their financial statements.

Gearing: A fundamental analysis ratio of a company's level of long-term debt compared to its equity capital.

Goodwill: An accounting concept meaning the value of an asset owned that is intangible but has a quantifiable "prudent value" in a business

Insider Trading: The buying or selling of a security by someone who has access to material, nonpublic information about the security.

Intrinsic Value: The actual value of a company or an asset based on an underlying perception of its true value including all aspects of the business, in terms of both tangible and intangible factors.

Margin of Safety: The difference between a stock’s price and its intrinsic value. This difference allows an investment to be made with minimal downside risk.

Mr. Market: An allegory created by Benjamin Graham. It explains the stock market tends to fluctuate, and that it is usually best to ignore these fluctuations when determining whether to buy or sell stocks.

Net-Net: A value investing technique in which a company is valued solely on its net current assets.

Off-Balance-Sheet: Contrast to loans, debt and equity, which do appear on the balance sheet.

Relative Value: A method of determining an asset's value that takes into account the value of similar assets.

Risk Management: The process of identification, analysis and either acceptance or mitigation of uncertainty in investment decision-making.

Value Trap: Stock traps attract investors who are looking for a bargain because these stocks are inexpensive. The trap springs when investors buy into the company at low prices and the stock never improves.

Source: Investopedia, Motley Fool

Discounted Cash Flow (DCF): A valuation method used to estimate the attractiveness of an investment opportunity. Discounted cash flow (DCF) analysis uses future free cash flow projections and discounts them (most often using the weighted average cost of capital) to arrive at a present value, which is used to evaluate the potential for investment. If the value arrived at through DCF analysis is higher than the current cost of the investment, the opportunity may be a good one.

Discount Rate: An interest rate used to bring future values into the present when considering the time value of money.

Dividend Discount Model (DDM): A means of estimating (not calculating) the value of company based on its dividend payouts, assuming certain increases to the dividend and growth in the company.

EBITDA/EV Multiple: A financial ratio that measures a company's return on investment. The EBITDA/EV ratio may be preferred over other measures of return because it is normalized for differences between companies. Using EBITDA normalizes for differences in capital structure, taxation and fixed asset accounting. Meanwhile, using enterprise value also normalizes for differences in a company’s capital structure.

Generally Accepted Accounting Principles (GAAP): The common set of accounting principles, standards and procedures that companies use to compile their financial statements.

Gearing: A fundamental analysis ratio of a company's level of long-term debt compared to its equity capital.

Goodwill: An accounting concept meaning the value of an asset owned that is intangible but has a quantifiable "prudent value" in a business

Insider Trading: The buying or selling of a security by someone who has access to material, nonpublic information about the security.

Intrinsic Value: The actual value of a company or an asset based on an underlying perception of its true value including all aspects of the business, in terms of both tangible and intangible factors.

Margin of Safety: The difference between a stock’s price and its intrinsic value. This difference allows an investment to be made with minimal downside risk.

Mr. Market: An allegory created by Benjamin Graham. It explains the stock market tends to fluctuate, and that it is usually best to ignore these fluctuations when determining whether to buy or sell stocks.

Net-Net: A value investing technique in which a company is valued solely on its net current assets.

Off-Balance-Sheet: Contrast to loans, debt and equity, which do appear on the balance sheet.

Relative Value: A method of determining an asset's value that takes into account the value of similar assets.

Risk Management: The process of identification, analysis and either acceptance or mitigation of uncertainty in investment decision-making.

Value Trap: Stock traps attract investors who are looking for a bargain because these stocks are inexpensive. The trap springs when investors buy into the company at low prices and the stock never improves.

Source: Investopedia, Motley Fool

Writing Example for Beginners of Value Investing

Date:Jan 30, 2013

Ticker: DE

Exchange:NYSE

Company Name:Deere & Company

Purchased Date:Jan 28, 2013

Purchased Price:$93.99

Current Price:$94.94

Target Price:$ XXX.XX

Company

Deere & Company manufactures and distributes a range of agricultural, construction and forestry, and commercial and consumer equipment. The Company supplies replacement parts for its own products and for those of other manufacturers. Deere also provides product and parts financing services. Deere and Company extends its services and products worldwide.

Date:Jan 30, 2013

Ticker: DE

Exchange:NYSE

Company Name:Deere & Company

Purchased Date:Jan 28, 2013

Purchased Price:$93.99

Current Price:$94.94

Target Price:$ XXX.XX

Company

Deere & Company manufactures and distributes a range of agricultural, construction and forestry, and commercial and consumer equipment. The Company supplies replacement parts for its own products and for those of other manufacturers. Deere also provides product and parts financing services. Deere and Company extends its services and products worldwide.

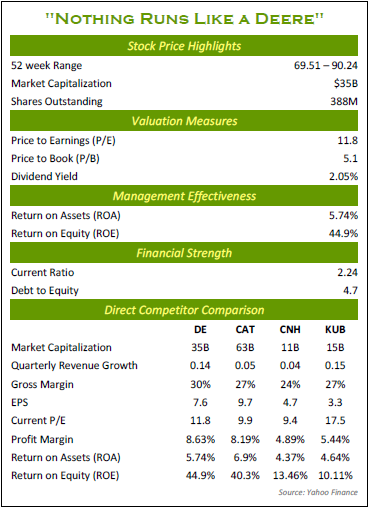

Valuations

The financial statement is a base to assess a firm’s value. The value is a composite sketch of current net asset, net worth, future earnings and growth potential. At a market capitalization of $31B, Deere has grown its Earnings Per Share (EPS) at a compounded rate of 25% over the past 10 years. The current share price compared to its per-share earnings (P/E ratio) of Deere is 12 near the bottom of its decade range of 8-20 and below its mean of 13.A low P/E ratio is generally an indication that Deere is a good value in relation to its market price. Deere's balance sheet is strong with over $6 billion in cash, equivalents and short-term investments and a current ratio of over two. A ratio of over two indicates that Deere has at least twice as many current assets as current liabilities. Debt levels are relatively high; $32.4B in short and long-term debt, but a large amount of the debt is related to high quality receivables from the financial services arm. Deere reported zero credit losses for fiscal year 2012, reflecting the excellent quality of the receivables. Deere paid annual dividends each year for the last 10 years, which has grown year-on-year by a factor of 16%.Deere’s ability to pay steady and increasing dividends over time provides tangible evidence of its financial stability and well-being. Deere’s ability to create value for shareholders over the long term is expressed by the firm’s economic profit spread between its 5-year historical Return on Invested Capital (ROIC) of 33% with its Weighted Average Cost of Capital (WACC) of 9.8%.Deere has the highest return on invested capital among U.S. industrial companies in the group.

Competitive Advantage

The global presence of Deere and its brand (John Deere) has given it a competitive advantage over foreign competitors (i.e. Kubota). Deere is in a great position in the race to emerging markets with dealers over 160 countries. Its peer Caterpillar has similar fundamentals, but China makes up 10% of Caterpillar’s business in Asia. Caterpillar's China operations have fuelled its profits in recent years as demand has been sluggish in developed economies, but the recent development has reversed that trend. Deere’s exposure in China is relatively modest compared with Caterpillar’s. Looking at the financial figures, Deere has the highest Return on Equity ratio (ROE) of 45% and 4 years average of 30%, which gives it a competitive edge over its peers. Another advantage is the R programming language used at Deere’s own statistical department for a number of important needs such as forecasting demand for equipment, forecasting crop yields, and optimizing the build orders on the tractor production line.

Sector

Short-term, high crop prices are expected to help Deere. Those crop insurance checks covering drought losses in 2012 will surely go to equipment purchases. Long-term, agriculture production will need to approximately double by 2050 to keep up with increased demand from population growth and standard of living increases. Increasing global food demand driven by rapid population growth directly contributes to higher demand for agricultural equipment.

Management

Samuel Allen (57) is only the ninth CEO in Deere’s 175-year history. Throughout his 34-year career at Deere, Allen has risen through the ranks and held various leadership positions in all divisions of the company.

The bottom line is that in the light of Deere’s attractive valuation, sustainable dividend yield, and positive long-term growth prospects, the stock remains a value buy.

The financial statement is a base to assess a firm’s value. The value is a composite sketch of current net asset, net worth, future earnings and growth potential. At a market capitalization of $31B, Deere has grown its Earnings Per Share (EPS) at a compounded rate of 25% over the past 10 years. The current share price compared to its per-share earnings (P/E ratio) of Deere is 12 near the bottom of its decade range of 8-20 and below its mean of 13.A low P/E ratio is generally an indication that Deere is a good value in relation to its market price. Deere's balance sheet is strong with over $6 billion in cash, equivalents and short-term investments and a current ratio of over two. A ratio of over two indicates that Deere has at least twice as many current assets as current liabilities. Debt levels are relatively high; $32.4B in short and long-term debt, but a large amount of the debt is related to high quality receivables from the financial services arm. Deere reported zero credit losses for fiscal year 2012, reflecting the excellent quality of the receivables. Deere paid annual dividends each year for the last 10 years, which has grown year-on-year by a factor of 16%.Deere’s ability to pay steady and increasing dividends over time provides tangible evidence of its financial stability and well-being. Deere’s ability to create value for shareholders over the long term is expressed by the firm’s economic profit spread between its 5-year historical Return on Invested Capital (ROIC) of 33% with its Weighted Average Cost of Capital (WACC) of 9.8%.Deere has the highest return on invested capital among U.S. industrial companies in the group.

Competitive Advantage

The global presence of Deere and its brand (John Deere) has given it a competitive advantage over foreign competitors (i.e. Kubota). Deere is in a great position in the race to emerging markets with dealers over 160 countries. Its peer Caterpillar has similar fundamentals, but China makes up 10% of Caterpillar’s business in Asia. Caterpillar's China operations have fuelled its profits in recent years as demand has been sluggish in developed economies, but the recent development has reversed that trend. Deere’s exposure in China is relatively modest compared with Caterpillar’s. Looking at the financial figures, Deere has the highest Return on Equity ratio (ROE) of 45% and 4 years average of 30%, which gives it a competitive edge over its peers. Another advantage is the R programming language used at Deere’s own statistical department for a number of important needs such as forecasting demand for equipment, forecasting crop yields, and optimizing the build orders on the tractor production line.

Sector

Short-term, high crop prices are expected to help Deere. Those crop insurance checks covering drought losses in 2012 will surely go to equipment purchases. Long-term, agriculture production will need to approximately double by 2050 to keep up with increased demand from population growth and standard of living increases. Increasing global food demand driven by rapid population growth directly contributes to higher demand for agricultural equipment.

Management

Samuel Allen (57) is only the ninth CEO in Deere’s 175-year history. Throughout his 34-year career at Deere, Allen has risen through the ranks and held various leadership positions in all divisions of the company.

The bottom line is that in the light of Deere’s attractive valuation, sustainable dividend yield, and positive long-term growth prospects, the stock remains a value buy.